An old banking scam has a new look. And it’s making the rounds again.

Recently Bank of America alerted its customers of the “Pay Yourself Scam,” where scammers use phony fraud alerts and trick their victims into giving them access to their online banking accounts. It’s a form of phishing attack, and according to Bank of America it goes something like this:

- You receive a text message that looks like a fraud alert from your bank about unusual activity. The text may look something like: “Did you make a purchase of $100.00 at ABC merchant?”

- If you respond to the text, you have now engaged the scammer and will receive a call from a number that appears to be from a bank.

- They’ll appear to be a representative from a bank and will offer to help stop the alleged fraud by asking you to send money to yourself with an online payment app.

- The scammer will ask you for a one-time code you just received from a bank.

- If you give them the code, they will use it to enroll their bank account details with an online payment service using your email address or phone number.

- The scammer can now receive your money into their account.

The good news is that you can avoid this attack rather easily. If you receive a text or call about a possible fraud alert, don’t respond. (Scammers can easily “spoof” or fake caller ID information nowadays. So even if it appears that the number looks legitimate, it may not be after all.) Instead, contact your bank directly using the contact information on your debit or credit card. This way, you’ll know you’re speaking with the proper representatives about the matter.

Other ways you can avoid online banking scams

Of course, this scam isn’t the only scam making the rounds these days. Whether it’s with some form of phishing attack, stealing passwords on public Wi-Fi, or malware that spies on your keystrokes, scammers use plenty of tricks to crack into online bank accounts. Yet with a few precautions and a sharp eye, you have several ways you can protect yourself.

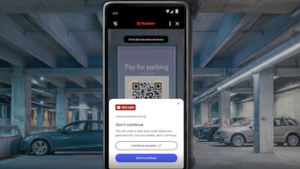

Use comprehensive online protection software

Online protection software today goes far beyond antivirus. It can protect your privacy, identity, and your online accounts as well. McAfee+ Ultimate provides our most comprehensive coverage with features that monitor the dark web and sketchy data broker sites for your personal information, identity theft and ransomware protection, and identity restoration services should the unexpected happen—all along with our award-winning antivirus protection. In all, it protects you, not just your devices. Together, it offers your strongest line of defense in the face of hackers, scammers, and thieves.

Scrutinize any messages claiming to be your bank

Legitimate banks will never pressure, harass, or cajole you into action. If you get a message that strikes an aggressive tone, assume it’s fraudulent. Other things legitimate banks will never do include:

- Banks or other financial institutions don’t call for your PIN or checking account number. Never provide this over the phone. Call your bank directly using the phone number on your debit or credit card or bank statement if you want to confirm.

- Your bank has no reason to email you for account information it already has. If you receive an email asking you to click a link or provide account information, assume it’s fraudulent. Don’t click any links and mark the email as spam.

- If a message appears to be from your bank asking you to sign in or enter your PIN, it’s a scam. Banks never ask customers for this information by text.

- A common theme in phishing emails is the urgent call to action. Cybercriminals want to scare you into acting immediately without thinking. The email says there was suspicious activity on your account, and you should log in immediately to avoid having it frozen or closed. No legitimate business would close a customer’s account without giving reasonable notice. Contact your bank through your normal channels to check your balance and account activity if you aren’t sure.

- Misspelled words and grammatical errors are another red flag. Major corporations have professional editors to make sure the content is correct.

Use your bank’s official website or app

Earlier, I mentioned contacting your bank directly to ensure you’re speaking to a proper representative. Another way you can go directly to the source is to use your bank’s website or app to check up on your accounts. Once again, don’t click any links in a text or email. Just go to your bank’s website or app to check your account. You can make sure you have your bank’s official app by visiting the Google Play or Apple’s App Store and looking at the information section to ensure that it was indeed developed by your bank—not a copycat.

Use strong, passwords and a password manager to stay on top of them all

Strong and unique passwords for each of your online accounts can help keep hackers at bay. With data breaches occurring so often, updating them regularly is important too. Yet with all the accounts we keep, that can mean a lot of work. However, a password manager can create those passwords for you and safely store them as well. Comprehensive security software will include one.

Use two-factor authentication on your accounts

Two-factor authentication is an extra layer of defense on top of your username and password. It adds in the use of a special one-time-use code to access your account, usually sent to you via email or to your phone by text or a phone call. In all, it combines something you know, like your password, with something you have, like your smartphone. Together, that makes it tougher for a crook to hack your account. If any of your accounts support two-factor authentication, the few extra seconds it takes to set up is more than worth the big boost in protection you’ll get.

Don’t access your online banking account via public Wi-Fi

When you log onto public Wi-Fi, potentially anyone can see your internet activity—and that includes things like entering your username and password. For that reason, only log into your bank account with public Wi-Fi if you’re using a virtual private network (VPN). McAfee Secure VPN protects your privacy by turning on automatically for unsecured networks. Your data is encrypted so it can’t be read by prying eyes. The VPN also keeps your online activity and physical location private and secure from advertisers.

Check your bank statements regularly

Keeping an eye on your bills and statements as they come in can help you spot unusual activity on your accounts. A credit monitoring service can do that one better by keeping daily tabs on changes to your credit report. While you can do this manually, there are limitations. First, it involves logging into each bureau and doing some digging of your own. Second, there are limitations as to how many free credit reports you can pull each year. A service does that for you and without impacting your credit score.

Depending on your location and plan, McAfee’s credit monitoring allows you to look after your credit score and the accounts within it to see fluctuations and help you identify unusual activity, all in one place, checking daily for signs of identity theft.

Prevention and vigilance are your best defense from online banking scams

When a fraud notification pops up on your phone, you can almost feel your stomach drop. Hackers and scammers play off that fear. They use it to get you to act—and to act quickly. Taking a moment to scrutinize these messages and following up directly with your bank can help you steer clear of their tricks. Likewise, putting up a strong defense with comprehensive online protection software can make you safer still. In the meantime, keep your eyes open for this “Pay Yourself Scam” and other scams like it. It’s certainly not the first of its kind, and it won’t be the last.