The Robinhood trading platform recently disclosed a data breach that exposed the information of millions of its customers. News of the attack was released on Monday, November 8th along with word the hackers behind it had demanded an extortion payment from the company.

According to Robinhood’s disclosure, the attack occurred on November 3rd, which allowed an unauthorized party to obtain the following:

- Email addresses for some 5 million people.

- Full names for another group of 2 million people.

In addition, smaller groups of Robinhood customers had yet more information compromised. Around 310 people had their names, birth dates, and zip codes exposed in the breach. Another 10 customers had “more extensive account details revealed,” per Robinhood’s disclosure.

Robinhood went on to say, “We believe that no Social Security numbers, bank account numbers, or debit card numbers were exposed and that there has been no financial loss to any customers as a result of the incident.”

Robinhood further stated that the company contained the intrusion and that it promptly informed law enforcement of the extortion demand. Robinhood says that it is continuing to investigate the incident with the assistance of a security firm.

The company advised its customers to visit the Robinhood help center to receive the latest messages from the company, noting that they will never include a link to access an account in a security alert.

Any data breach that you and your information may have been involved in calls for a few quick security steps:

1. Log into your account and update your password with a new one that is strong and unique. Likewise, if you use the same or similar passwords across several accounts, change those as well. (A password manager that’s included with comprehensive online protection software can do that work for you.) Set up two-factor authentication if your account allows for it, as this will provide an extra layer of protection as well.

2. Review your statements for any strange activity—even the smallest of withdrawals or transactions could be the sign of a larger issue.

3. Report any suspected fraud to the company or institution involved. They typically have set policies and procedures in place to provide support.

If you believe that you’ve become a victim of identity theft, file a report with local law enforcement and the Federal Trade Commission (FTC). Law enforcement can provide you with a case number that you may need as part of the recovery process. Likewise, the FTC’s identity theft website provides excellent resources, including a recovery plan and a step-by-step walkthrough if you create an account with them.

For even more information, visit our blog that points out the signs of identity theft and the steps you can take should you find yourself victim.

After the breach, keep a sharp eye out

Given that the breach apparently exposed some 5 million email addresses, there’s the risk that these may end up in the hands of bad actors who may use them for follow-on attacks.

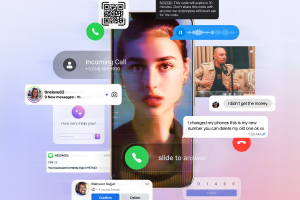

Notable among them would be phishing attacks, where hackers could target Robinhood users with phony messages in an attempt to get affected users to reveal further account information. For example, hackers could potentially create bogus emails that appear to come from Robinhood and direct users to a malicious site that requests account information. As Robinhood stated, the company will never include a link to access an account in a security alert. Users should visit the Robinhood site directly for account information.

This breach could lead to other phishing attacks as well, ones that may or may not pose as communication from Robinhood. Some of these phishing attacks can be rather easy to spot, as they may include typos, poorly rendered logos, or spoofed web addresses. However, some sophisticated hackers can roll out rather polished phishing attacks that can closely resemble legitimate communications.

In all, people can avoid falling victim to phishing attacks by keeping the following in mind:

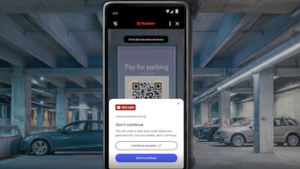

1. Only access your accounts directly from the official website of the company or financial institution involved. If you receive an email, message, or text alerting you of an issue, do not click any links provided in the communication. Go straight to the site yourself by typing in the proper address and view your account information there. Likewise, calling the customer support line posted on their official site is an option as well.

2. Use comprehensive online protection software that includes a spam filter. This can prevent phishing emails from reaching your inbox in the first place.

3. Get to know the signs of phishing emails. A common sign of a scam is an email, ad, message, or site that simply doesn’t look or read right. (Maybe the grammar is awkward or the logo is grainy or has the colors slightly wrong.) However, some of them can look quite convincing, yet there are still ways to spot an attempted phishing attack.

4. Beware of email attachments you aren’t expecting. This is always good form because hackers love to spike attachments with malware that’s designed to steal your personal information. Whether you get an unexpected attachment from a friend or business, follow up before opening it. That’s a quick way to find out if the attachment is legitimate or not.

For more info on phishing and how to steer clear of it, check out our blog on how to spot phishing attacks.

Protect your identity for the long haul

The unfortunate fact is that data breaches can and do happen. Many of the larger data breaches make the headlines, yet many more do not—such as the ones that hit small businesses, restaurants, and medical care providers. In the hands of hackers, the information spilled by these breaches can provide them with the building blocks to commit identity theft. As a result, keeping on top of your identity and personal information is a must.

The good news is that you have solid options to prevent them from harming you or at least greatly lessen their potential impact. With identity theft protection, even in the short-term, you can monitor emails addresses and usernames that are being used to breach other accounts. You can monitor dozens of different types of personal information and receive alerts to keep an eye out for misuse. Likewise, it can monitor your email addresses and bank accounts for signs of misuse or fraud, plus provide theft protection and support from a recovery specialist if identity theft, unfortunately, happens to you.

Along those same lines, news of a data breach offers all of us a moment to pause and take stock of just how protected we are. Above and beyond the steps covered above, comprehensive online protection can protect your devices from malware, phishing attacks, malicious websites, and other threats. More importantly, it protects you—your identity and privacy, particularly in times where breaches such as the one we’re talking about here occur with seeming regularity.